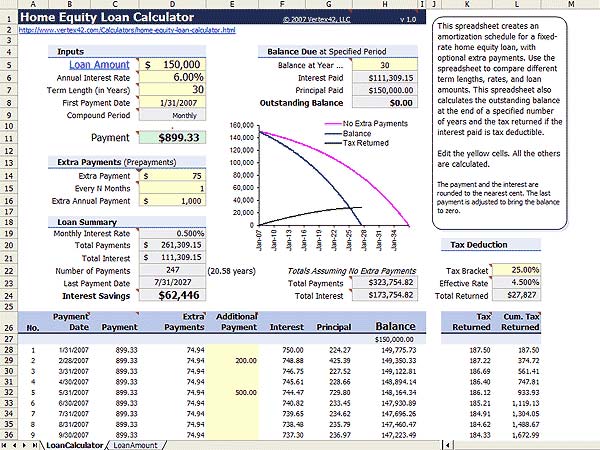

When everything looks good, and you need to evaluate your home. Professional service, which will cost about $ 500. If you do not have this document and the information, nobody will work with you. It 's a simple way to assess your financial situation. The following advice I can give you is do your research online you'll see a lot of valuable information. For example, his assessment of the house of cards you can safely and securely, using a calculator for home equity loans.

The next important consideration in finding a lender to know over 80% of its loans to the value of your home. This is the minimum and do not recommend you go if there is not the case. You know, you want to enjoy their situation. These are the main problems of the provider to make a decision:

Bankruptcy is not very popular with donors. In this case, you must provide and display the result of two years between application and the bankruptcy filing. You can verify that you have made efforts to restore their credit. Children and small debts as hospital bills, utility payments or slow I'm not a big problem for them. In any case, if you can erase and do know the current situation, we arrive in good condition. And this is what it should be. When the process begins, the end is not necessary to establish clearly the closing costs. You do not want any surprises when everything is finalized.

I hope you enjoyed my article for more information on the experts of your mortgage. This is the path to be on track. And remember two important points that we learned today: get the assessment document and to establish new principles of closing costs.